Why Financial Planning is Your First Step in a Divorce

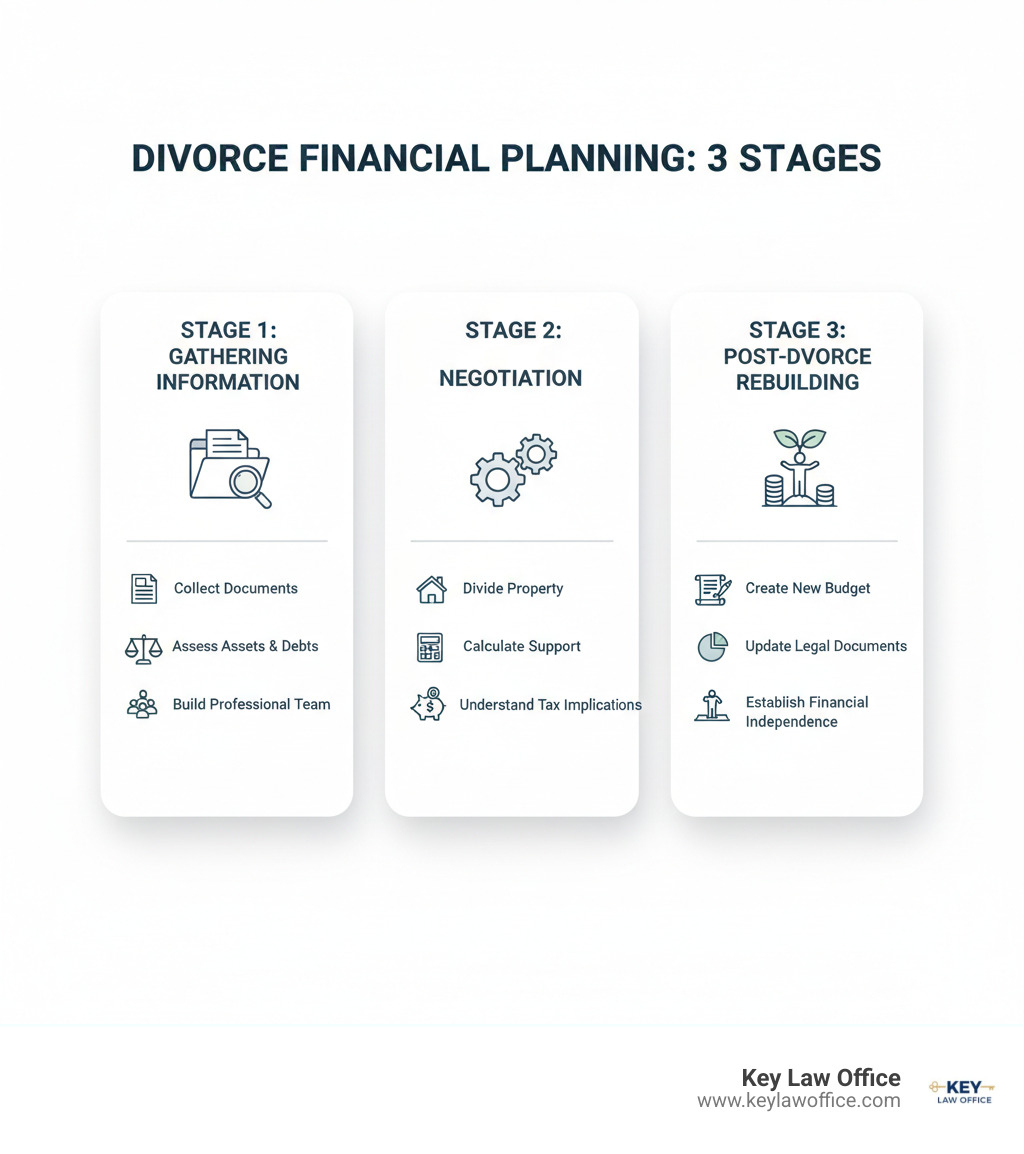

Divorce financial planning is the comprehensive process of gathering financial information, analyzing assets and debts, and creating data-driven strategies to protect your financial future during and after a divorce. It involves working with a team of professionals to fully understand how property division, support payments, and complex tax implications will impact your long-term financial stability and independence.

Key components of divorce financial planning include:

- Gathering Financial Documents: This is the bedrock of your entire case. It involves a meticulous collection of tax returns, bank statements, investment account records, property deeds, and more. Without a complete set of documents, you are negotiating in the dark.

- Asset and Debt Division: This step involves creating a comprehensive inventory of everything you own and owe as a couple. The crucial part is distinguishing between marital property (acquired during the marriage) and separate property (owned before marriage or received as a gift/inheritance). This classification directly impacts what is subject to division.

- Support Calculations: This involves a detailed analysis of income, expenses, and earning potential to understand potential alimony (spousal support) and child support obligations. These calculations are not arbitrary; they are based on state-specific guidelines and numerous individual factors.

- Strategic Tax Planning: The way assets are divided can have significant, and often surprising, tax consequences. A $100,000 brokerage account is not the same as $100,000 in home equity if selling the stocks triggers a large capital gains tax bill. Effective planning aims to minimize the tax burden for both parties.

- Post-Divorce Budgeting: This is about looking forward. It involves creating a realistic, sustainable financial plan for your new, single-income (or supplemented-income) household. This budget will be your guide to achieving long-term financial independence and security.

Divorce is one of life’s most challenging transitions — both emotionally and financially. More than two million North Americans will divorce this year, and 100% of divorces involve financial settlements. The stakes are particularly high for those over 50, as the “gray divorce” rate has doubled in the past 20 years according to research by Bowling Green State University. For this demographic, there is often limited time to rebuild financial security before retirement, making strategic planning absolutely critical.

The emotional trauma of divorce can cloud your judgment when making critical financial decisions. Research shows that divorced individuals typically need over a 30% increase in income to maintain their previous standard of living. Women face an even steeper challenge, with household income dropping an average of 41% after divorce — nearly twice the income drop experienced by men. This disparity is often due to factors like career interruptions for child-rearing, persistent wage gaps, and taking on primary caregiver roles post-divorce, which can limit earning potential.

Clear-headed financial decision-making creates a strong foundation for long-term confidence. As one financial expert noted, “Divorce is fundamentally a financial transaction,” and treating it with that level of objectivity can help you secure a better outcome.

I’m Tyler Key, Managing Attorney at Key Law Office, and over the past 10+ years, I’ve guided hundreds of families through divorce financial planning challenges in Central Texas. My experience has shown that combining strong legal advocacy with practical, step-by-step divorce financial planning guidance makes the process far more manageable for my clients. It transforms a process that feels chaotic and overwhelming into a structured path forward. My goal is to empower you with the clarity and confidence needed to make the best possible decisions for your future, ensuring that the legal outcome aligns with your long-term financial well-being.

Phase 1: Assembling Your Financial Picture and Professional Team

Starting your divorce financial planning journey can feel like standing at the base of a mountain, looking up at what seems like an impossible climb. But here’s the truth: taking that first step to organize your financial life is actually empowering. Think of this phase as creating a detailed roadmap of where you stand financially today — and it’s absolutely essential for protecting your future. This isn’t just about defense; it’s about offense. It’s about taking control of the narrative of your financial life instead of letting the divorce process dictate it for you. Each document you find, each account you list, is a step up that mountain, giving you a clearer view of the landscape and the path ahead.

The goal here isn’t just paperwork for paperwork’s sake. We’re building a complete picture of your financial landscape — every asset, every debt, every income stream. This information becomes your foundation for making smart decisions about your future.

I’ve seen too many clients who waited until after their divorce was final to start thinking seriously about their finances. Don’t make that mistake. The earlier you start gathering documents and understanding your financial situation, the better position you’ll be in during negotiations.

This phase involves several key steps: compiling every financial document you can find, creating a comprehensive inventory of assets and debts, identifying any hidden assets your spouse might have, and protecting your credit score throughout the process. Let’s explore each of these areas.

Your Financial Document Checklist

Gathering financial documents might feel overwhelming, but think of it like collecting puzzle pieces. Each document tells part of your financial story, and together they create the complete picture your legal team needs to protect your interests.

Start by making copies of everything — and I mean everything. Store the originals safely and give copies to your attorney. This isn’t just about being thorough; it’s about protecting yourself if documents mysteriously disappear or if your spouse tries to hide financial information.

Here are the essential documents we’ll need to review together:

Tax returns from the last 3-5 years provide a comprehensive overview of your household income, deductions, and tax situation. We scrutinize these for clues about all income sources, including freelance work, rental income, or business profits that might not be immediately obvious. They also reveal investment gains or losses and charitable contributions, painting a picture of your family’s complete financial activities.

Bank statements and credit card statements show your family’s spending patterns and cash flow. A careful review of 12-24 months of statements can uncover recurring payments to unknown accounts, large cash withdrawals, or significant spending on items you’ve never seen, which can be red flags for hidden assets or the dissipation of marital funds.

Investment and retirement account statements are vital for understanding your long-term financial picture. It’s important to gather statements from the beginning of the marriage if possible, as this can help trace any separate property claims (e.g., funds you had in a 401(k) before getting married). We need to understand the full value and nature of these assets, from simple IRAs to complex stock option plans.

Property deeds and vehicle titles prove ownership and help us accurately assess the value of your real estate and vehicles for division purposes. These documents establish legal ownership, but we will also likely need professional appraisals to determine the fair market value of these assets, which is the figure used in settlement negotiations.

Loan and mortgage documents detail all your outstanding debts — mortgages, car loans, student loans, credit cards, and personal loans. Understanding who is legally obligated on each debt is critical. If your name is on a joint credit card or mortgage, you are legally responsible for the entire amount, even if your divorce decree says your ex-spouse will pay it. This is a crucial area for risk management.

Insurance policies including life, health, disability, homeowners, and auto coverage help us assess your current protection and plan for your future insurance needs. We’ll look at life insurance policies to identify beneficiaries and any cash surrender value. For health insurance, we’ll need to plan for post-divorce coverage, which might involve COBRA or a new marketplace plan. This is a significant and often overlooked future expense.

If you have premarital agreements, these documents are absolutely foundational. In Texas, a community property state, a valid premarital agreement can significantly alter the standard rules of property division. It is the first document we will review as it sets the legal framework for your financial settlement.

Don’t forget to review your monthly expenses and expected income changes. This helps us understand the real-world impact of divorce on your day-to-day finances and plan accordingly.

Building Your Professional Team: Lawyer vs. Financial Advisor

Here’s something many people don’t realize: successfully navigating divorce requires more than just legal expertise. You need both legal guidance and specialized financial counsel working together to protect your future.

Your divorce lawyer serves as your legal advocate and strategist. They understand family law, represent you in court proceedings, negotiate on your behalf, and draft all the legal agreements that will govern your post-divorce life. When it comes to the legal aspects of property division, spousal support, and child custody, your attorney is indispensable.

But there’s another professional who can be equally valuable: a Certified Divorce Financial Analyst (CDFA). While your lawyer handles the legal strategy, a CDFA focuses specifically on the financial implications of your divorce decisions.

| Role | Divorce Lawyer | Certified Divorce Financial Analyst (CDFA) |

|---|---|---|

| Primary Focus | Legal strategy, court representation, drafting agreements | Financial analysis, long-term planning, budget projections |

| Key Services | Negotiating settlements, filing legal documents, protecting your legal rights | Analyzing settlement options, projecting financial outcomes, creating post-divorce budgets |

| When You Need Them | From the beginning of divorce proceedings through finalization | During settlement discussions and for long-term financial planning |

| Expertise | Family law, court procedures, legal precedents | Financial planning, tax implications, retirement planning |

A CDFA can run different settlement scenarios to show you the long-term financial impact of your decisions. Using specialized software, they can project the long-term financial impact of, for example, keeping the house versus taking more liquid assets. They can show you in black and white how different settlement proposals will affect your cash flow, net worth, and retirement security 5, 10, or 20 years down the line. This data-driven approach removes emotion and guesswork from the equation.

For high net worth divorce situations, having both professionals on your team becomes even more critical. In some cases, your team may need to expand further. A forensic accountant can be invaluable if you suspect your spouse is hiding assets or misrepresenting income. A business valuator may be needed to determine the true worth of a shared business. Your attorney will help you determine if these additional experts are necessary to protect your interests.

The key is understanding that these professionals complement each other. Your lawyer protects your legal interests, while a CDFA and other financial experts help ensure the decisions you make today will support the life you want to build tomorrow. The goal is to assemble a team where each professional provides a specific, crucial piece of the puzzle, all working in concert under the direction of your legal counsel.